How does apprenticeship funding work?

Oh boy, apprenticeship funding is confusing.

Here’s the basic idea, which I stole from the technical funding guide that the ESFA published.

The scenario

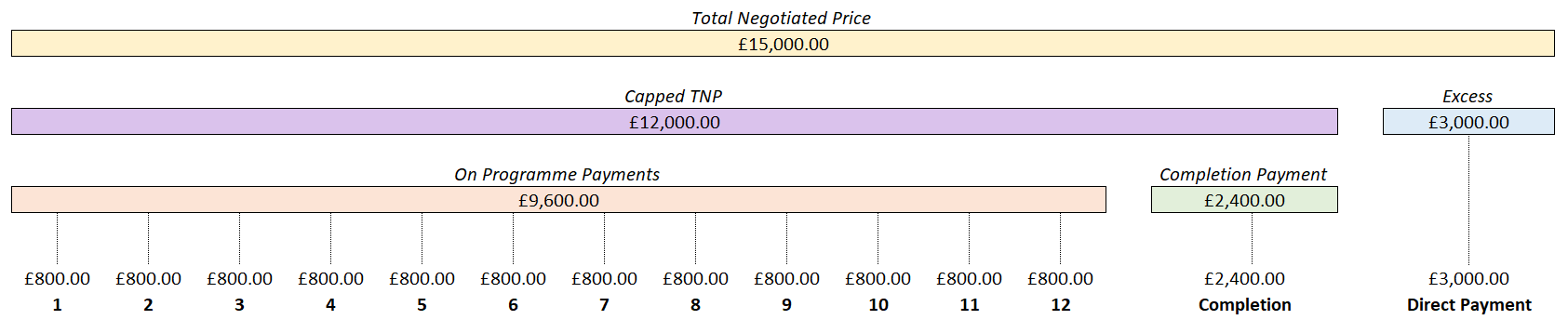

Let’s imagine we have a 12 month apprenticeship with a funding cap of £12,000. That cap is there because the ESFA don’t think it should cost any more than that to deliver the apprenticeship.

The training provider agrees a TNP (Total Negotiated Price) of £15,000 with the employer because… well sometimes that’s the way things go.

The funding cap

The first thing that the ESFA will do is slice off anything above the funding cap - they’re not interested in that at all.

In this case, that’s £3,000, and the employer will have to pay it themselves - they can’t use their levy funds even if they have some spare. Cash or card thank you.

So that leaves us with £12,000 to pay to the training provider. Let’s call this the capped TNP (this capping wouldn’t need to happen if the TNP was less than the funding cap, in that case we’d just take the TNP as it is).

The completion payment

The next thing that the ESFA will do is chop 20% off the capped TNP and put it to one side - this is the completion payment.

The ESFA will only release this money if the apprentice completes all their learning and enters End Point Assessment. They don’t have to achieve, but they do need to complete.

In our example, the completion payment is £2,400.

On programme payments

Next, the ESFA will take the remaining 80% of the capped TNP (80% of £12,000 is £9,600) and divide it over the number of planned study months.

Our example apprenticeship runs for 12 months, so we’ll do £9,600 divided by 12, which gives us a monthly on programme payment of £800.

Who pays?

The last question is: who pays?

There are two different payment mechanisms that can be used - levy payments and co-investment.

Levy payments

For businesses that have a levy account, they can use the money in their account to pay the monthly on programme costs to the training provider.

Co-investment

For businesses that either don’t have enough in their account, or just don’t use the levy system at all, the ESFA will cover most of the cost each month. They still expect the employer to pay something, and for recent apprenticeships this is 5% of the total (older apprenticeships required a 10% payment from the employer).

Worked example

The tables below demonstrate how this plays out for three different employers.

Employer A

The employer has sufficient funds in their levy account to pay the monthly contributions.

| Month | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | Completion |

| On Programme | £800 | £800 | £800 | £800 | £800 | £800 | £800 | £800 | £800 | £800 | £800 | £800 | £2,400 |

| Available Levy | £1,000 | £1,000 | £1,000 | £1,000 | £1,000 | £1,000 | £1,000 | £1,000 | £1,000 | £1,000 | £1,000 | £1,000 | £4,000 |

| Levy Payment | £800 | £800 | £800 | £800 | £800 | £800 | £800 | £800 | £800 | £800 | £800 | £800 | £2,400 |

| Balance | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 |

Employer B

The employer has no funds in their levy account (or they are a non-levy-paying organisation).

| Month | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | Completion |

| On Programme | £800 | £800 | £800 | £800 | £800 | £800 | £800 | £800 | £800 | £800 | £800 | £800 | £2,400 |

| Available Levy | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 |

| Levy Payment | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 |

| Balance | £800 | £800 | £800 | £800 | £800 | £800 | £800 | £800 | £800 | £800 | £800 | £800 | £2,400 |

| Gov Co-Investment | £760 | £760 | £760 | £760 | £760 | £760 | £760 | £760 | £760 | £760 | £760 | £760 | £2,280 |

| Emp Co-Investment | £40 | £40 | £40 | £40 | £40 | £40 | £40 | £40 | £40 | £40 | £40 | £40 | £120 |

Employer C

The employer has some funds in their levy account, but not enough to pay the full monthly amounts.

| Month | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | Completion |

| On Programme | £800 | £800 | £800 | £800 | £800 | £800 | £800 | £800 | £800 | £800 | £800 | £800 | £2,400 |

| Available Levy | £300 | £300 | £300 | £300 | £300 | £300 | £300 | £300 | £300 | £300 | £300 | £300 | £300 |

| Levy Payment | £300 | £300 | £300 | £300 | £300 | £300 | £300 | £300 | £300 | £300 | £300 | £300 | £300 |

| Balance | £500 | £500 | £500 | £500 | £500 | £500 | £500 | £500 | £500 | £500 | £500 | £500 | £2,100 |

| Gov Co-Investment | £475 | £475 | £475 | £475 | £475 | £475 | £475 | £475 | £475 | £475 | £475 | £475 | £1,995 |

| Emp Co-Investment | £25 | £25 | £25 | £25 | £25 | £25 | £25 | £25 | £25 | £25 | £25 | £25 | £105 |